Financial Assistant: Your Companion in Structure a Secure Future

Financial Assistant: Your Companion in Structure a Secure Future

Blog Article

Accessibility Versatile Lending Providers Designed to Fit Your Unique Scenario

In today's vibrant financial landscape, the relevance of accessing flexible lending solutions tailored to specific scenarios can not be overstated. As individuals browse with life's numerous turning points and unexpected obstacles, having the ideal financial backing can make all the distinction. Imagine having a lending service that adjusts to your unique requirements, supplying a variety of alternatives that align with your certain situation. This degree of modification can offer a feeling of security and empowerment, allowing you to navigate economic choices with confidence. What precisely makes these adaptable financing services stand out, and exactly how can they truly cater to your ever-evolving economic needs?

Benefits of Flexible Funding Services

Flexible lending solutions use consumers the advantage of personalizing payment terms to fit their monetary scenarios and goals. This degree of customization offers a series of benefits to borrowers. It enables people to pick a settlement routine that aligns with their revenue frequency, whether it be weekly, bi-weekly, or monthly. This flexibility makes sure that borrowers can easily manage their settlements without experiencing monetary stress. Customers can pick between fixed or variable interest rates based on their risk resistance and economic approach. This option equips consumers to pick one of the most cost-efficient service for their specific situation. Additionally, adaptable lending solutions typically use the ability to make extra settlements or repay the funding early without sustaining penalties. This attribute enables borrowers to minimize interest prices and increase their path to debt-free status. On the whole, the advantages of versatile funding solutions offer consumers with the devices they require to efficiently handle their financial resources and attain their lasting economic goals.

Recognizing Your Loaning Options

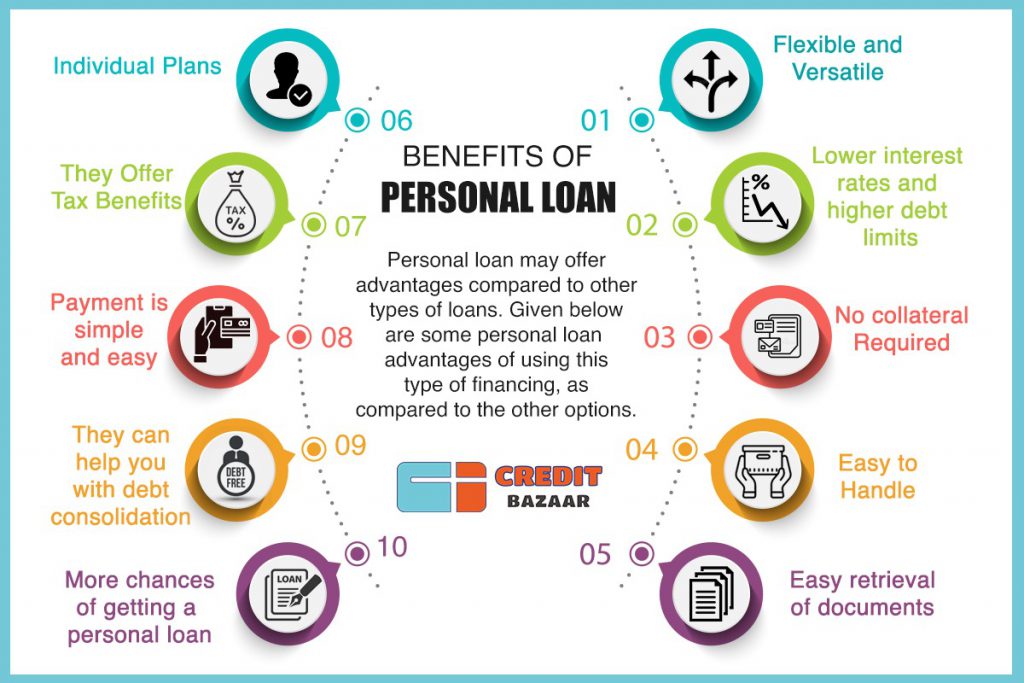

Checking out the different loaning alternatives available can provide people with valuable insights right into picking the most appropriate economic remedy for their requirements. When considering obtaining alternatives, it is necessary to be educated concerning the various kinds of fundings and their terms. Personal loans, for example, are functional and can be made use of for numerous objectives, such as debt consolidation, home renovations, or unanticipated costs. On the various other hand, car loans are specifically tailored for purchasing lorries, using affordable interest prices and terms. For individuals looking to finance college, trainee car loans present a feasible choice with flexible payment plans. Additionally, people with existing homeownership can utilize home equity loans or lines of credit to gain access to funds based on the equity in their homes. Recognizing these borrowing choices enables people to make informed choices based on their monetary objectives and situations, ensuring that they choose the most appropriate loan product to fulfill their needs.

Tailoring Car Loan Terms to Your Requirements

When consumers assess their economic needs abreast with numerous financing alternatives, they can purposefully personalize funding terms to fit their certain requirements. Tailoring funding terms entails a thorough evaluation of elements such as the desired loan quantity, repayment period, passion prices, and any type of additional costs. By comprehending these elements, debtors can work out with loan providers to create a car loan agreement that straightens with their monetary goals.

In addition, customers can bargain for adaptable terms that allow for modifications in situation of unanticipated monetary obstacles. This could include options for repayment deferments, funding expansions, or alterations to the repayment schedule. Eventually, tailoring finance terms to specific demands can result in a much more workable and individualized loaning experience.

Taking Care Of Settlement Easily

To guarantee a smooth and efficient repayment process, borrowers should proactively plan and arrange their economic management strategies. Setting up a specialized payment routine can assist individuals remain on track and stay clear of missed or late payments. It is advisable to leverage tools such as automatic payments or schedule suggestions to make certain prompt repayments. Additionally, creating a budget that focuses on lending settlements can assist in handling finances properly.

In instances where debtors encounter economic difficulties, it is essential to communicate with the loan provider promptly. Lots of lenders supply alternatives such as car loan restructuring or temporary repayment deferments to help look at this now individuals encountering challenges. mca lending. Financial Assistant. By being transparent about financial situations, customers can work in the direction of mutually beneficial solutions with the lending institution

In addition, it is valuable to check out chances for early payment if practical. Repaying the finance in advance of routine can minimize general rate of interest costs and give monetary relief in the long run. By remaining proactive, interacting freely, and exploring settlement techniques, borrowers can properly manage their lending responsibilities and achieve economic stability.

Safeguarding Your Financial Future

Protecting your economic future is an important element of achieving peace of mind and long-lasting stability. By creating an extensive monetary strategy, people can establish clear objectives, develop a budget, conserve for emergencies, invest carefully, and safeguard their possessions with insurance policy protection.

In addition, diversifying your investments can help reduce dangers and enhance general returns - mca funders. By spreading financial investments throughout various possession courses such as stocks, bonds, and actual estate, you can decrease the effect of market fluctuations on your profile. Frequently reviewing and changing your economic plan as your conditions change is just as essential to remain on track in the direction of your goals

In significance, persistent monetary preparation is the foundation for a safe and secure financial future. It supplies a roadmap for attaining your objectives, weathering unforeseen obstacles, and ultimately taking pleasure in financial stability and tranquility of mind in the years ahead.

Conclusion

In final thought, adaptable car loan solutions supply a range of benefits for debtors, giving customized options to fit specific financial scenarios. By recognizing borrowing options and personalizing loan terms, individuals can quickly manage payment and protect their monetary future. It is vital to discover these adaptable loan services to ensure a positive financial result and accomplish lasting economic security.

Report this page