Financial Assistant: Directing You Towards Your Monetary Goals

Financial Assistant: Directing You Towards Your Monetary Goals

Blog Article

Access Flexible Finance Solutions Designed to Match Your Special Scenario

In today's dynamic monetary landscape, the relevance of accessing versatile lending solutions customized to specific scenarios can not be overemphasized. What specifically makes these adaptable loan services stand out, and exactly how can they truly provide to your ever-evolving financial demands?

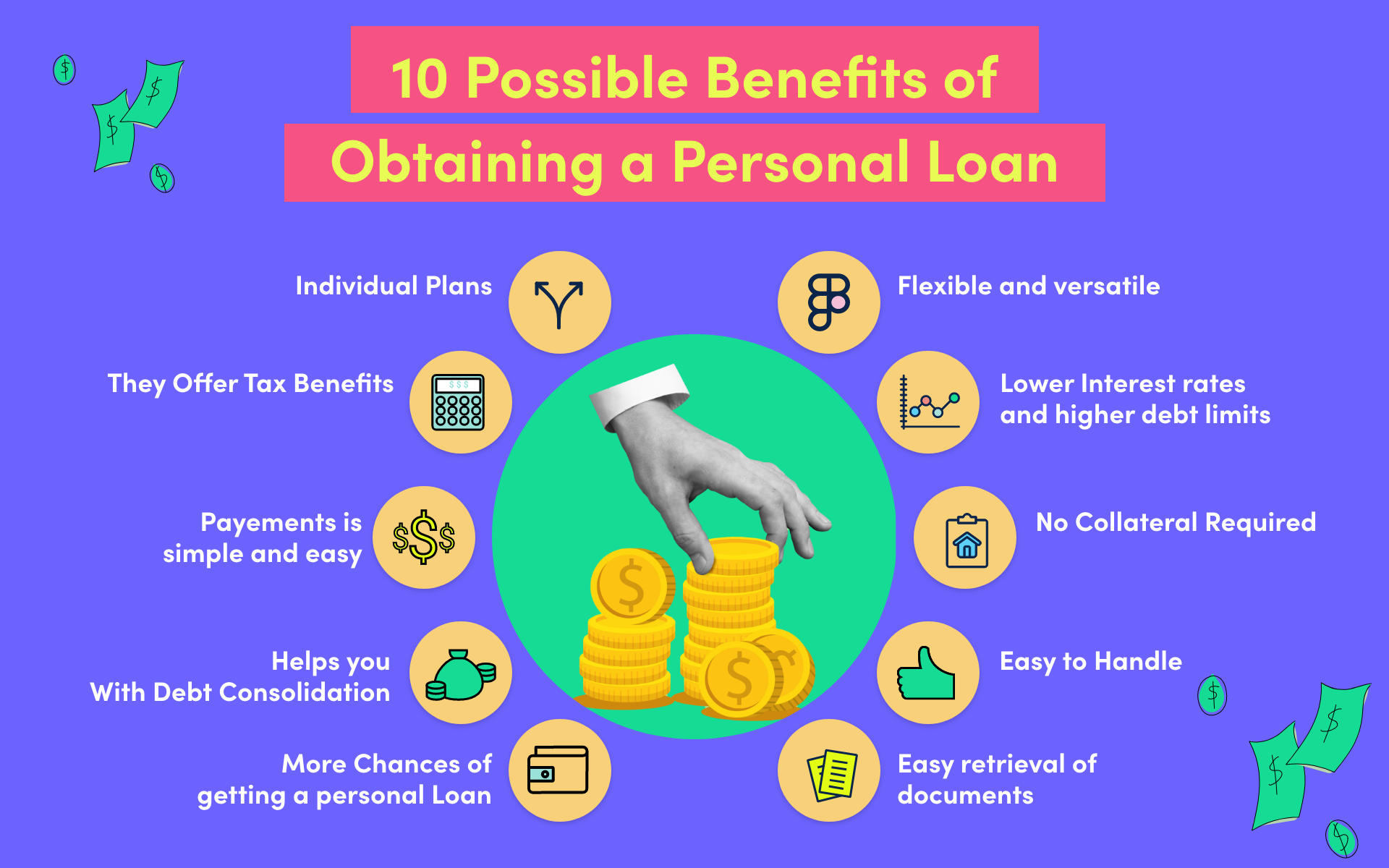

Advantages of Flexible Loan Provider

Versatile lending solutions provide borrowers the advantage of customizing payment terms to match their economic circumstances and goals. This degree of personalization offers a variety of benefits to debtors. Firstly, it allows individuals to pick a repayment schedule that lines up with their earnings frequency, whether it be once a week, bi-weekly, or monthly. This versatility guarantees that consumers can pleasantly handle their settlements without experiencing financial pressure. Consumers can pick in between set or variable rate of interest rates based on their threat resistance and financial approach. This alternative empowers consumers to pick the most affordable remedy for their particular scenario. In addition, versatile lending solutions commonly offer the ability to make additional settlements or pay off the financing early without incurring penalties. This attribute makes it possible for consumers to minimize passion expenses and accelerate their path to debt-free condition. On the whole, the benefits of adaptable funding solutions provide borrowers with the tools they need to efficiently handle their finances and accomplish their long-term economic goals.

Understanding Your Loaning Options

For individuals looking to finance higher education and learning, trainee lendings offer a sensible choice with versatile repayment plans. Additionally, people with existing homeownership can leverage home equity financings or lines of credit rating to gain access to funds based on the equity in their homes. Understanding these loaning alternatives enables people to make informed choices based on their monetary objectives and situations, making certain that they choose the most suitable lending product to fulfill their requirements.

Tailoring Finance Terms to Your Demands

When borrowers evaluate their financial demands abreast with numerous finance choices, they can strategically customize lending terms to suit their certain requirements. Customizing finance terms includes a thorough evaluation of elements such as the desired financing amount, repayment period, rate of interest rates, and any additional fees. By recognizing these elements, debtors can discuss with loan providers to create a funding agreement that his comment is here aligns with their monetary objectives.

Moreover, debtors can work out for adaptable terms that allow for modifications in situation of unanticipated monetary challenges. This can include options for payment deferments, lending expansions, or adjustments to the payment timetable. Eventually, tailoring finance terms to private needs can bring about a more convenient and individualized borrowing experience.

Taking Care Of Repayment Easily

To guarantee a smooth and reliable repayment process, debtors ought to proactively plan and organize their monetary administration strategies. Additionally, developing a budget plan that prioritizes finance payments can aid in managing finances effectively.

In cases where consumers experience financial difficulties, it is essential to communicate with the lender quickly. Numerous lenders use options such as financing restructuring or temporary settlement deferments to help individuals encountering difficulties. best mca lenders. Loan Service. By being clear concerning economic circumstances, consumers can function towards equally valuable options with the lending institution

Additionally, it is beneficial to check out possibilities for very early repayment if feasible. Settling the funding in advance of routine can reduce overall passion prices and offer financial relief in the long run. By remaining aggressive, communicating openly, and discovering repayment strategies, customers can successfully manage their finance responsibilities and attain economic stability.

Safeguarding Your Financial Future

Just how can persistent monetary planning lead the way for a protected and stable future? Protecting your economic future is a vital element of accomplishing assurance and long-term security. By developing a comprehensive economic plan, individuals can set clear goals, develop a budget, conserve for emergencies, spend carefully, and protect their properties through insurance policy protection. Planning for retired life is likewise necessary, making certain that you have adequate funds to maintain your lifestyle after you quit working.

Moreover, expanding your investments can assist mitigate risks and enhance total returns - mca loan companies. By spreading investments across different property courses such as supplies, bonds, and property, you can reduce the effect of market changes on your profile. Frequently examining and readjusting your economic plan as your scenarios alter is similarly vital to remain on track in the direction of your goals

Fundamentally, thorough economic planning is the foundation for a protected monetary future. It supplies a roadmap for achieving your goals, weathering unforeseen obstacles, and inevitably enjoying economic stability and satisfaction in the years ahead.

Conclusion

Finally, versatile lending services provide a series of advantages for borrowers, providing customized choices to fit private economic circumstances. By recognizing borrowing alternatives and tailoring car loan terms, individuals can quickly take care of repayment and secure their financial future. It is crucial to check out these adaptable financing solutions to ensure a positive financial outcome and achieve long-term financial stability.

Report this page