Achieve Your Desires with the Assistance of Loan Service Specialists

Achieve Your Desires with the Assistance of Loan Service Specialists

Blog Article

Accessibility Versatile Car Loan Services Designed to Fit Your Distinct Scenario

In today's vibrant financial landscape, the importance of accessing flexible funding solutions customized to private circumstances can not be overstated. What precisely makes these versatile financing solutions stand out, and just how can they truly cater to your ever-evolving financial requirements?

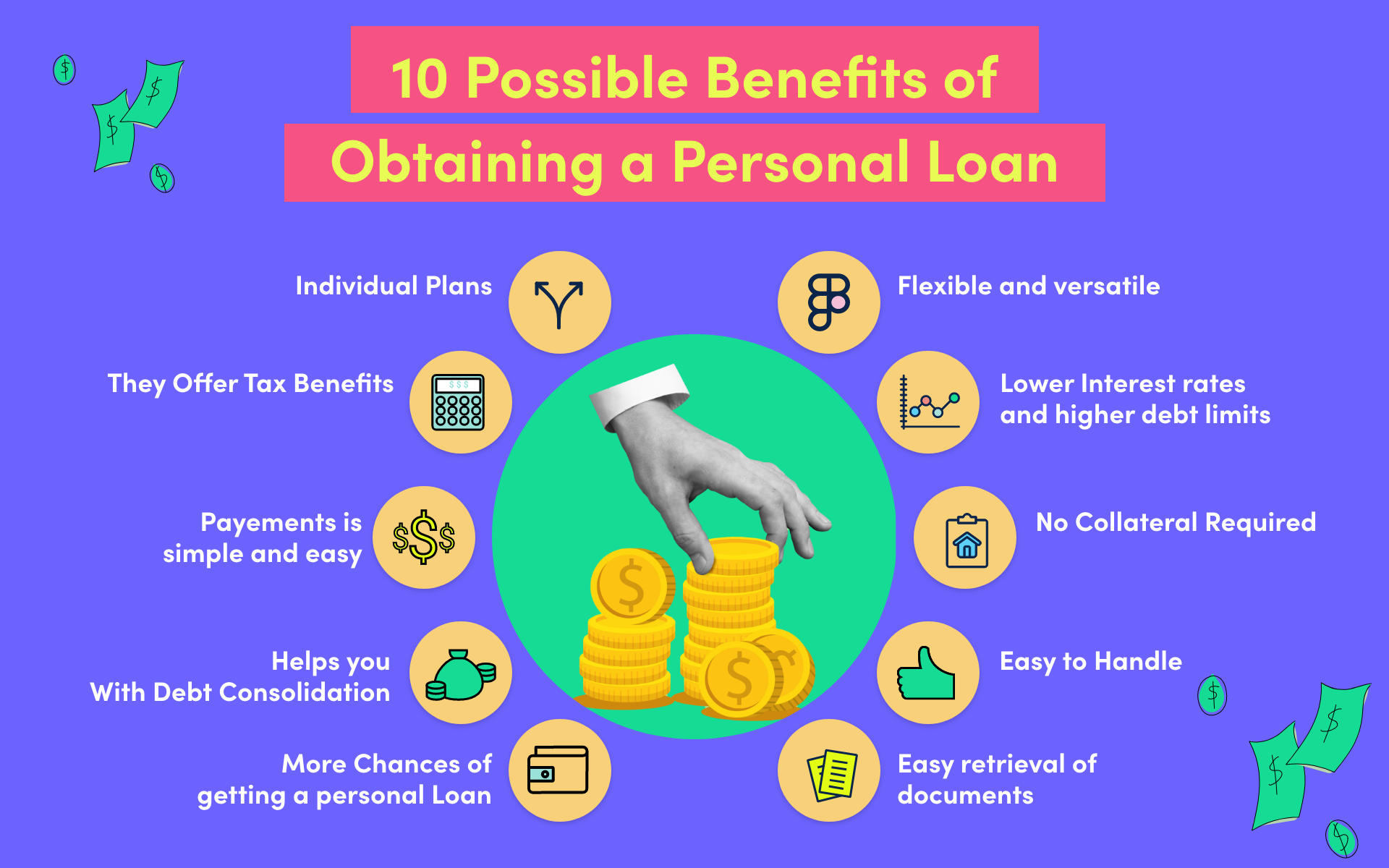

Advantages of Flexible Financing Solutions

Adaptable loan solutions offer customers the advantage of tailoring settlement terms to match their monetary scenarios and objectives. This level of personalization gives a series of advantages to debtors. It enables individuals to select a settlement timetable that lines up with their income regularity, whether it be regular, bi-weekly, or monthly. This versatility ensures that consumers can pleasantly handle their payments without experiencing economic stress. Customers can choose in between fixed or variable passion rates based on their danger tolerance and financial method. This choice empowers borrowers to select the most affordable option for their particular situation. In addition, adaptable loan solutions typically offer the capability to make added repayments or repay the car loan early without sustaining penalties. This attribute enables debtors to minimize rate of interest prices and accelerate their course to debt-free standing. In general, the advantages of flexible finance services provide debtors with the tools they require to efficiently handle their financial resources and achieve their long-lasting financial goals.

Recognizing Your Loaning Options

For individuals looking to finance higher education and learning, pupil fundings present a practical option with adaptable payment plans. In addition, individuals with existing homeownership can utilize home equity financings or lines of credit scores to access funds based on the equity in their homes. Comprehending these loaning choices permits individuals to make enlightened decisions based on their economic objectives and scenarios, making sure that they pick the most proper finance item to meet their needs.

Tailoring Funding Terms to Your Demands

When borrowers assess their economic needs abreast with numerous finance alternatives, they can tactically personalize funding terms to fit their particular needs. Tailoring loan terms involves a detailed analysis of aspects such as the preferred funding amount, repayment period, rate of interest prices, and any type of extra charges. By comprehending these aspects, debtors can work out with lenders to create a funding arrangement that lines up with their economic objectives.

Additionally, customers can negotiate for adaptable terms that permit changes in instance of unexpected financial difficulties. This might consist of alternatives for settlement deferments, finance expansions, or alterations to the repayment schedule. Inevitably, customizing loan terms to specific demands can bring about a much more manageable and customized borrowing experience.

Managing Repayment With Ease

To make certain a smooth and reliable payment process, debtors must proactively plan and organize their economic monitoring approaches. Furthermore, producing a spending plan that prioritizes finance settlements can aid in managing financial resources efficiently.

In situations where debtors encounter monetary difficulties, it is important to interact with the loan provider immediately. Numerous lending institutions offer choices such as finance restructuring or temporary payment deferrals to aid individuals facing obstacles. same day merchant cash advance. Financial Assistant. By being clear concerning economic circumstances, debtors can function in the direction of equally beneficial solutions with the lender

Furthermore, it is valuable to explore possibilities for early settlement if feasible. Settling the loan in advance of schedule can reduce total rate of interest costs and give monetary relief in the future. By remaining positive, communicating freely, and checking out settlement methods, customers can effectively handle their finance responsibilities and achieve economic security.

Safeguarding Your Financial Future

Exactly how can persistent economic planning lead the means for a safe and stable future? Protecting your financial future is an essential facet of attaining assurance and long-term security. By creating a thorough monetary plan, people can establish clear goals, develop a budget, save for emergencies, spend carefully, and secure their assets with insurance policy protection. Planning for retirement is likewise essential, guaranteeing that you have enough funds to maintain your lifestyle after you quit working.

Furthermore, diversifying your investments can assist alleviate threats and boost overall returns - merchant cash advance loan same day funding. By spreading out financial investments across different asset courses such as supplies, bonds, and genuine estate, you can lower the effect of market changes on your portfolio. Regularly assessing and changing your financial strategy as your scenarios alter is equally crucial to stay on track towards your goals

In essence, persistent monetary preparation is the structure for a safe economic future. It offers a roadmap for achieving your objectives, weathering unanticipated challenges, and ultimately appreciating financial security and assurance in the years to come.

Final Thought

To conclude, flexible loan services use a variety of advantages for borrowers, offering customized options to match specific financial situations. By comprehending borrowing choices and tailoring loan terms, individuals can easily manage payment and protect their economic future. It is essential to explore these flexible finance services to make sure a favorable financial outcome and accomplish lasting economic security.

Report this page